Create a lasting impact for generations to come

Your legacy—it’s your chance to create lasting impact with generations to come, and to give them the best possible future.

But choosing where, how and to whom to give is an important decision that requires careful thought. You want to provide your best to your family—but you are also inspired to help kids who need the best health care possible.

With legacy giving, you don’t have to choose.

Legacy gifts enable you to give much more beyond your lifetime than what you’re able to give right now. And with its tax benefits, legacy gifts go even further.

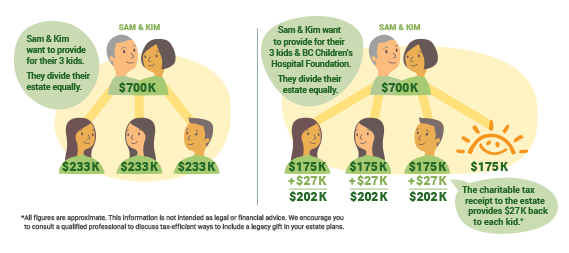

A legacy gift to a charitable organization like BC Children’s Hospital Foundation will not only make a positive difference for your family through tax savings, but it will also help the hospital meet its most urgent needs in children’s health care.

It helps to advance life-saving discoveries that previously didn’t exist in areas like precision medicine and digital technologies. These discoveries take time, and legacy giving can help transform these new possibilities into future breakthroughs that will take child health to the next level.

Create a legacy that benefits your family—and the cause you love

When BC Children’s Hospital Foundation is included as a recipient on a legacy gift, the impact of your gift grows, because the taxes associated with your assets are reduced or eliminated through a charitable tax receipt.

Here’s an example of how legacy giving could work with a Will: