Tax expert Joyce Lee shares top tips

Your Will is an essential document, but how can it help you prepare for your loved ones’ futures and make an impact in the lives of others?

- Make one when you’re healthy. A Will often takes time and a clear mind to settle. Since we can’t predict health or other unexpected issues, it’s best not to leave the planning until a critical event.

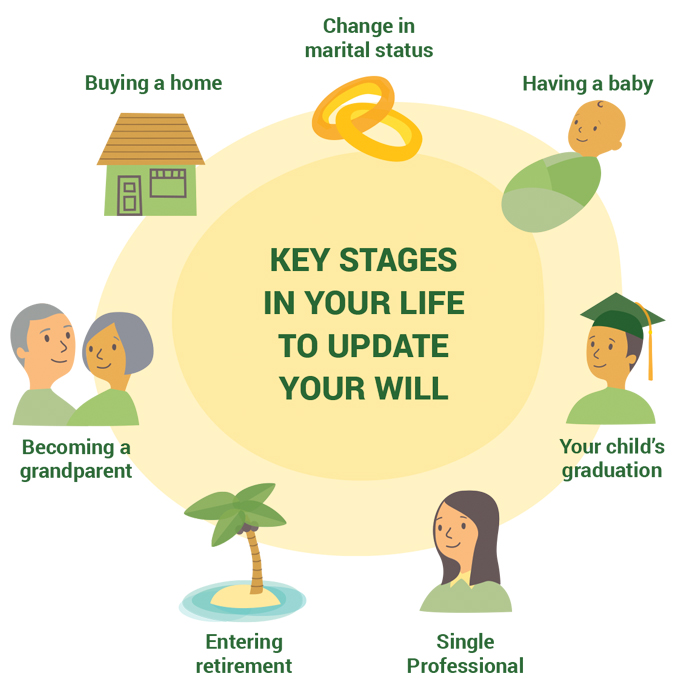

- Update it regularly. Revise your Will at different stages of life, as your assets and circumstances change. It’s also helpful to discuss powers of attorney and representation agreements, which cover financial and health situations. Every update to your Will is also an opportunity to consider a gift to a charity to ensure your values continue into the future.

- Help your family. A Will can avoid additional time, expense and confusion to family members when they have to decide who will take responsibility for the administration of your estate. Without a Will, the administrator needs to do the extra step of getting consensus from family and applying to the Court for approval to act. While your lawyer should file a Wills Notice stating where the Will is stored, remember to let your executor know as well.

- Remember to record your wishes. Don’t leave everything to one person on the understanding that person will distribute your estate the way you intend. If your wishes aren’t recorded in your Will, there’s no accountability to the rightful beneficiaries—which means there’s a high risk that gifts to individuals and charities won’t be fulfilled. If a donation is not contained in the Will, the charity cannot issue a charitable tax receipt to the estate.

Joyce Lee, Q.C., is a partner at Deloitte Legal Canada LLP and a long-time member of BC Children’s Hospital Foundation’s Chinese-Canadian Planned Gift Committee. To learn more of Joyce Lee’s helpful tips, visit our Legacy Resources page.

Joyce Lee, Q.C., is a partner at Deloitte Legal Canada LLP and a long-time member of BC Children’s Hospital Foundation’s Chinese-Canadian Planned Gift Committee. To learn more of Joyce Lee’s helpful tips, visit our Legacy Resources page.